MONTREAL, May 17, 2021-- Dynacor Gold Mines Inc. (TSX: DNG / OTC: DNGDF) (Dynacor or the Corporation) released its unaudited consolidated financial statements and the management's discussion and analysis (MD&A) for the first quarter ended March 31, 2021.

These documents have been filed electronically with SEDAR at www.sedar.com and will be available on the Corporation's website www.dynacor.com.

(All figures in this press release are in Ms of US$ unless stated otherwise. All amounts per share are in US$. All variance % are calculated from rounded figures. Some additions might be incorrect due to rounding).

Q1-2021 OVERVIEW AND HIGHLIGHTS

OVERVIEW

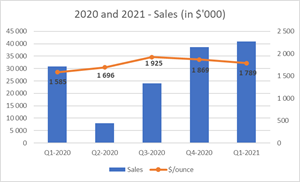

Dynacor completed the three-month period ended March 31, 2021 (“Q1-2021”) with quarterly record sales of $40.9 million and a net income of $2.1 million (US$0.05 per share), ahead of annual guidance, compared to sales of $30.9 million and a net income of $2.4 million (US$0.06 per share) in the first quarter of 2020 (“Q1-2020”).

Despite the annual rainy season period in Peru, the Corporation continued attracting a large volume of ore, purchasing 32,135 tonnes which is just under the level of purchases in Q4-2020. This resulted as well in the highest Q1 gold production in the Corporation’s history.

Despite a slightly declining gold market price, the Corporation was able to increase its quarterly sales for the third consecutive quarter.

Compared to last year, the increase in sales is even more remarkable given that Q1-2020 sales included approximately $8.7 million coming from December 2019 postponed gold exports.

The Corporation also recently announced a $1.8 million investment through internally generated cash flow to expand its Veta Dorada ore processing plant capacity. The new plant expansion will enable to increase production, improve cost efficiencies, create jobs and elevate Dynacor as Peru's largest ASM gold ore purchaser and processer.

HIGHLIGHTS

Operational

-

Highest quarterly volume processed. In Q1-2021 the Veta Dorada plant processed a volume of 29,327 tonnes of ore (326 tpd) compared to 22,901 tonnes (297 tpd) in Q1-2020 a 28.1% increase and historical Q1 high. (Considering 90 days in Q1-2021 and 77 potential working days due to Covid-19 restrictions plant shut-down in Q1-2020);

-

Significant increase in quarterly production. During Q1-2021, gold equivalent production amounted to 21,975 AuEq ounces compared to 13,542 AuEq ounces in Q1-2020, representing an increase of 62.3%;

-

Increase in ore inventory despite the annual rainy season. With an ore purchase volume of 32,135 tonnes in Q1-2021, the Corporation completed Q1-2021 with a level of inventory exceeding 11,000 tonnes. Consequently, the Corporation decided to bring forward the mill expansion.

Financial

-

32.4% increase in Sales. With higher quantities and average gold market price, sales amounted to $40.9 million in Q1-2021 compared with $30.9 million in Q1-2020;

-

Increased gross operating margin. Gross operating margin of $5.3 million in Q1-2021, an increase of 8.2% compared to $4.9 million in Q1-2020;

-

Quarter to quarter increase in Net income. Net income and comprehensive income of $2.1 million ($0.05 per share) compared to $1.4 million in Q4-2020 and $2.4 million in Q1-2020;

-

Strong cash gross operating margin. Cash gross operating margin of $257 per AuEq ounce sold (1) compared to $283 in Q1-2020;

-

Increased EBITDA(2). $4.6 million compared to $4.3 million in Q1-2020;

-

Stable cash-flow from operating activities before change in working capital items. Cash flow from operating activities before change in working capital items of $3.1 million ($0.08 per share) (3) similar to Q1-2020;

-

Improved cash position. Cash on hand of $17.2 million at March 31, 2021 compared to $11.9 million at year-end 2020.

Cash Return to Shareholders

-

Change in dividend policy. Starting in February 2021, a CA$0.005 monthly dividend per share is paid replacing the CA$0.015 quarterly dividend. During Q1-2021, dividends totaling $0.8 million (CA$ 1.0 million) were paid.

(1) Cash gross operating margin per AuEq ounce is in US$ and is calculated by subtracting the average cash cost of sale per equivalent ounces of Au from the average selling price per equivalent ounces of Au and is a non-IFRS financial performance measure with no standard definition under IFRS. It is therefore possible that this measure could not be comparable with a similar measure of another company.

(2) EBITDA: “Earnings before interest, taxes and depreciation” is a non-IFRS financial performance measure with no standard definition under IFRS. It is therefore possible that this measure could not be comparable with a similar measure of another corporation. The Corporation uses this non-IFRS measure as an indicator of the cash generated by the operations and allows investor to compare the profitability of the Corporation with others by canceling effects of different assets bases, effects due to different tax structures as well as the effects of different capital structures.

(3) Cash-flow per share is a non-IFRS financial performance measure with no standard definition under IFRS. It is therefore possible that this measure could not be comparable with a similar measure of another corporation. The Corporation uses this non-IFRS measure which can also be helpful to investors as it provides a result which can be compared with the Corporation market share price.

RESULTS FROM OPERATIONS

Extract from Consolidated Statement of net income and comprehensive income

|

For the three-month periods |

||

|

(in $'000) (unaudited) |

2021 |

2020 |

|

Sales |

40,909 |

30,869 |

|

Cost of sales |

(35,606) |

(25,920) |

|

Gross operating margin |

5,303 |

4,949 |

|

General and administrative expenses |

(1,208) |

(1,091) |

|

Other project expenses |

(16) |

(128) |

|

Operating income |

4,079 |

3,730 |

|

Income before income taxes |

3,928 |

3,647 |

|

Current income tax expense |

(1,554) |

(1,223) |

|

Deferred income tax expense, |

(268) |

(39) |

|

Net income and comprehensive income |

2,106 |

2,385 |

|

Earnings per share |

||

|

Basic |

$0.05 |

$0.06 |

|

Diluted |

$0.05 |

$0.06 |

Total sales amounted to $40.9 million compared to $30.9 million in Q1-2020. The $10.0 million increase is explained by higher volume of gold sold ($5.4 million) at a higher average gold price ($4.6 million). The Q1-2021 gold production also beneficiated from a significantly higher gold recovery (+3.4%) compared to Q1-2020.

The Q1-2021 gross operating margin reached $5.3 million which represents 13.0% of sales. This level is higher than the forecast of the Corporation. Compared to 2020, the gross operating margin was negatively impacted by the declining trend of gold market price.

General and administrative expenses amounted to $1.2 million in Q1-2021, a $0.1 million increase compared to Q1-2020.

The Q1-2021 net income was impacted by the recording of a $0.3 million deferred income tax expense resulting from FX variances between the $US and the Peruvian Sol applying on long term assets local tax basis.

Reconciliation of non-IFRS measures

|

(in $'000) (unaudited) |

For the three-month periods |

|

|

2021 |

2020 |

|

|

Reconciliation of net income and comprehensive income to EBITDA |

||

|

Net income and comprehensive income |

2,106 |

2,385 |

|

Income taxes expense (current and deferred) |

1,821 |

1,262 |

|

Financial expenses |

51 |

18 |

|

Depreciation |

643 |

640 |

|

EBITDA |

4,621 |

4,305 |

CASH FLOW FROM OPERATING, INVESTING AND FINANCING ACTIVITIES AND

WORKING CAPITAL AND LIQUIDITY

Operating activities

For the three-month period ended March 31, 2021, the cash flow from operations, before changes in working capital items, amounted to $3.1 million, similar to last year. Net cash from operating activities amounted to $6.8 million compared to $13.1 million for the three-month period ended March 31, 2020. Changes in working capital items amounted to $3.7 million compared to $9.8 million in Q1-2020.

Investing activities

During the three-month period ended March 31, 2021, the Corporation invested $0.5 million (very limited investments in the comparative period). This amount is mainly comprised of investments at the plant notably in relation to the increase in capacity and improvements in production processes and to new vehicles.

Financing activities

In Q1-2021, with the change in dividend policy, three dividends totaling CA$0.025 per share were disbursed for a total consideration of $0.8 million (CA$ 1.0 million). In Q1-2020, a quarterly dividend was disbursed for a total consideration of $0.4 million (CA$ 0.6 million).

During the period, 51,225 common shares were repurchased under the Corporation’s normal course issuer bid share buyback program for a total cash consideration of $0.08 million or CA$ 0.1 million (none in Q1-2020).

Working capital and liquidity

As at March 31, 2021, the Corporation’s working capital amounted to $27.4 million, including $17.2 million in cash ($25.4 million, including $11.9 million in cash as at December 31, 2020).

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at March 31, 2021, total assets amounted to $78.4 million ($76.3 million as at December 31, 2020). Major variances since last year-end come from the significant increase in cash, the decrease in inventories mainly due to the decrease in gold in process and the impact of the additional deferred tax liability recorded in Q1-2021.

|

(in $'000) (unaudited) |

As at |

As at |

|

2021 |

2020 |

|

|

Cash |

17,239 |

11,868 |

|

Accounts receivable |

7,177 |

8,434 |

|

Inventories |

11,433 |

13,401 |

|

Property, plant and equipment |

19,707 |

19,677 |

|

Right-of-use assets |

654 |

834 |

|

Exploration and evaluation assets |

18,508 |

18,510 |

|

Other assets |

3,729 |

3,572 |

|

Total assets |

78,447 |

76,296 |

|

Trade and other payables |

7,031 |

7,082 |

|

Asset retirement obligations |

3,567 |

3,604 |

|

Current tax liabilities |

1,537 |

1,124 |

|

Deferred tax liabilities |

1,304 |

1,036 |

|

Lease liabilities |

631 |

706 |

|

Shareholders' equity |

64,377 |

62,744 |

|

Total liabilities and equity |

78,447 |

76,296 |

OUTLOOK 2021

Ore processing

Contrary to previous years and despite the annual rainy season, the Corporation was able to even increase its ore inventory during Q1-2021. With this inventory level and current strong ore purchases, the Corporation has initiated in March ahead of its initial planned schedule the expansion project of its Veta Dorada processing plant which will increase the throughput level from its actual 345 tpd to 430 tpd, an increase of 25.0%. The expansion is scheduled to be completed on time and on budget.

For 2021, the Corporation issued financial and capital expenditure guidance(1), forecasting $150.0 million in sales and a net income of $6.9 million (US$0.18 per share). As at March 31, 2021, the Corporation is slightly ahead of its 2021 financial guidance.

On May 13, the Corporation released its April 2021 monthly sales figure which amounted to $12.5 million (unaudited).

(1) Assumptions

i) average CA/US exchange rate of 1.273:1

ii) 2021 financial guidance is based on an average gold price of $US 1,850 per ounce (Year-end 2020 rate).

ABOUT DYNACOR

Dynacor is a dividend-paying industrial gold ore processor headquartered in Montreal, Canada. The corporation is engaged in gold production through the processing of ore purchased from the ASM (artisanal and small-scale mining) industry. At present, Dynacor operates in Peru, where its management and processing teams have decades of experience working with ASM miners. It also owns a gold exploration property (Tumipampa) in the Apurimac department.

The corporation intends to expand its processing operations in other jurisdictions as well.

Dynacor produces environmental and socially responsible gold through its PX IMPACT® gold program. A growing number of supportive firms from the fine luxury jewelry, watchmakers and investment sectors pay a small premium to our customer and strategic partner for this PX IMPACT® gold. The premium provides direct investment to develop health and education projects for our artisanal and small-scale miner’s communities.

Dynacor is listed on the Toronto Stock Exchange (DNG) and the OTC in the United States under the symbol (DNGDF).

FORWARD-LOOKING INFORMATION

Certain statements in the preceding may constitute forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Dynacor, or industry results, to be materially different from any future result, performance or achievement expressed or implied by such forward-looking statements. These statements reflect management’s current expectations regarding future events and operating performance as of the date of this news release.

Toronto Stock Exchange (TSX): DNG

OTC (United States): DNGDF

Shares Outstanding: 38,727,524

Website: http://www.dynacor.com

Twitter: http://twitter.com/DynacorGold

PDF available: http://ml.globenewswire.com/Resource/Download/327feff3-6a4e-443a-9511-88b9ee670337

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5b981dbc-949d-4567-b35b-f5d9cec598b0

CONTACT: For more information, please contact: Director, Shareholder Relations Dale Nejmeldeen Dynacor Gold Mines Inc. T: 514-393-9000 #230 E: investors@dynacor.com